Three Sigma’s Research for Harmony's Derivatives & Perpetuals

Sustainable DeFi with Onchain Options & Futures

1. Introduction

The Current State of DeFi Derivatives

The DeFi landscape has witnessed significant growth, with derivatives emerging as one of the few sectors demonstrating consistent expansion. Among derivatives, perpetual protocols have achieved a robust product-market fit, becoming a preferred trading platform for users seeking onchain solutions. Platforms such as Hyperliquid, GMX, dYdX, Vertex, Bluefin, and Jupiter collectively see close to $300 billion traded monthly, underscoring the importance and demand for these products.

However, the Harmony ecosystem, despite its potential, currently lacks a vibrant DeFi presence. When it comes to the derivatives space, there's not much activity. As Harmony positions itself to become a DeFi hub, there is a need to re-ignite its ecosystem, starting with a strong foundation in DeFi derivatives.

This research is undertaken with a clear objective: to kickstart the development of Harmony's DeFi derivatives ecosystem, ensuring it is self-sustainable. Our approach focuses on ensuring that any solutions are fully onchain, minimize dependencies, and remain open-source. This strategy not only aligns with the core principles of decentralization but also mitigates risks and allows for an agile development cycle.

2. Foundational Assessment

Evaluating Derivatives Protocols

Based on the criteria and constraints established by Harmony, an extensive evaluation of derivatives protocols was conducted. In total, 82 different protocols were analyzed. Each protocol was assessed based on several key factors: whether all its components are onchain, if the GitHub repository is open, if the protocol is on an EVM chain, the type of oracle it utilizes (push vs. pull), its traction within the market, and more. The aim was to select approximately 3 protocols for quick deployment on Harmony. Panoptic, Opyn Squeeth, and GMX V1 were deemed the most promising short-term candidates.

Opyn Squeeth currently charges no fees. However, its codebase has a "fee switch" similar to Uniswap's. Although the protocol has not generated revenue for Opyn thus far, this fee switch can be activated upon forking. This would address the goal of creating a product capable of earning fees. Additionally, the GitHub repository contains all the strategies, crab/bull. This can also allow for the fee to remain at 0 initially (as-is) and then implement a fee structure similar to DOVs for the strategies. For example, a 1% annualized management fee and a 10% performance fee.

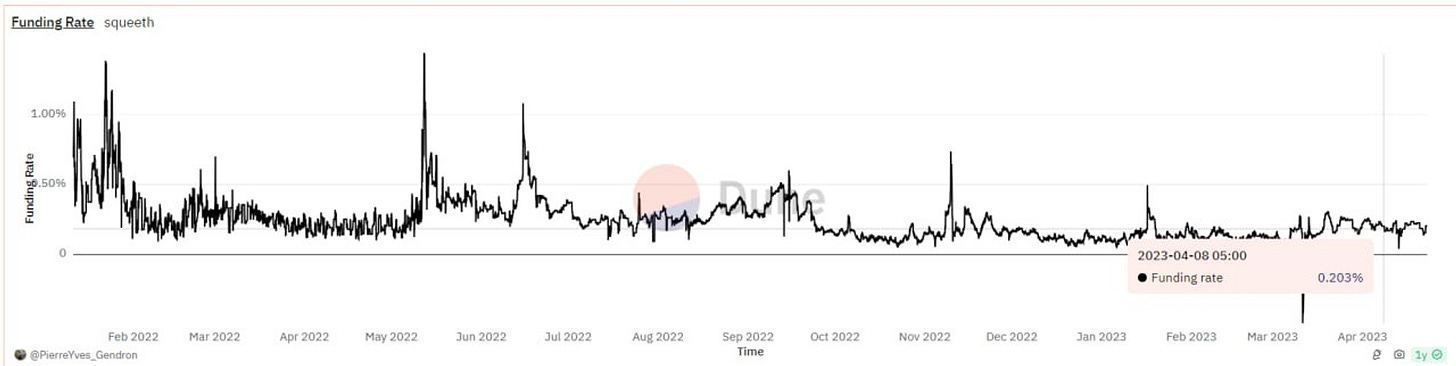

However, a problem with Squeeth is the very high funding rates. It is not meant to be held for a long time. The daily funding was at around 0.30%~0.40% 1 month before the merge as people started to long ETH. It's very easy for Uniswap LPs hedging their positions to see their positions bleed 5-10% of their whole position in a month. At that point, to effectively hedge, you'd need to rebalance your portfolio.

Despite Squeeth not being as used as it was in 2022-2023, the funding rates are still high as shown on Amberdata, roughly 0.15% per day.

Panoptic is an oracleless protocol with a single external dependency on Uniswap V3 for deployment. It charges fees to both option buyers and sellers, which are allocated to Panoptic Liquidity Providers (PLPs). The protocol can also retain a percentage of these fees.

Panoptic's weakness and why it ranked lower than Squeeth is that it has no proven product-to-market fit. Squeeth has been live since January 2022, while Panoptic has yet to launch its mainnet, despite conducting some beta tests on L2s and alternative L1s.

3. Dependency Analysis

Both Panoptic and Opyn are dependent on Uniswap V3, though in distinct ways. Panoptic requires liquidity to be redeployed on Uniswap V3 to function effectively. In contrast, Opyn relies on Uniswap V3 to enable users to long Squeeth by purchasing spot oSqueeth directly on the platform.

4. Evaluation of Third Candidate Protocols

The evaluation of the third chosen candidate is more complex due to the numerous protocols with substantial Product-Market-Fit (PMF), volume, and other metrics, but they come with an increasing number of dependencies. These candidates can be split into several groups based on their characteristics and requirements.

GMX V1 has been forked multiple times and is a flagship DeFi protocol on Arbitrum. Many protocols are built on top of GMX. However, some key functions run offchain, such as the keepers that match the oracle price with the order price and handle liquidations. These would need to be developed from scratch if considered for deployment on a new chain.

Opyn Gamma would need a Decentralized Options Vault (DOV) protocol to run strategies on top of it, as options protocols alone have historically struggled to gain traction. Essentially, Opyn Gamma provides the infrastructure to mint options, but pricing these options would be the buyer's or seller's responsibility, which is the challenging part of executing onchain.

Gearbox is a fascinating primitive offering undercollateralized lending, enabling degen-yield-farming. However, it requires a competitive yield-farming ecosystem, which currently does not apply to Harmony.

5. Protocols with Higher Requirements

GMX V2, Synthetix V2, and Synthetix V3

These protocols demand pull oracles. Given that the only oracle available is a push oracle provided by Band, this requirement cannot be met currently. Once a pull oracle is available, these protocols can be revisited.

Gains Network shares some similarities with GMX V1, such as their reliance on a network of keepers, vault and oracle-based, and having a proven PMF, thus able to generate fees. However, a key difference lies in their counterparty assets. Gains Network uses a stablecoin (DAI in GNS V6) for all trades, requiring a stable and liquid asset for smooth transactions. GMX V1, on the other hand, partially mitigates this by using a basket of assets.

The team at Perpetual Protocol currently acts as the primary market maker on their platform, responsible for approximately 30% of the total trading volume. On Perp V3 (Neko DEX), they are the exclusive market maker, at least during the alpha phase, where only the Perp V3 team is involved. While the platform is fully onchain and operates independently of external protocols or vendors, it still demands active market-making—a significant requirement and burden. Notably, the market-making strategies employed by the team are not open-source. However, they have provided a template for a maker strategy on Perp V2.

Finally, the fifth category of protocols was excluded protocols during the initial screening due to factors such as extensive onchain or offchain dependencies or the lack of an open-source license. Examples of protocols in this category include dYdX V4, Vela, Contango, IPOR, Voltz, and others.

6. Campaigns and Incentives

Attracting Users to the Ecosystem

Once the three chosen primitives were decided to be forked and deployed on Harmony, the next challenge is attracting users. To address this, running a points campaign could provide real incentives for user participation. Let's examine the campaign strategies of our candidate protocols:

Panoptic is preparing to launch the PIPS campaign, a strategic initiative designed to incentivize early adopters and liquidity providers on the Ethereum blockchain. The campaign is set to go live shortly after Panoptic is deployed on the mainnet, anticipated in the coming weeks. PIPS, short for "Panoptic Incentive Points", are a reward system designed to encourage participation and liquidity provision on the Panoptic platform.

The PIPS campaign offers a tiered reward system that boosts participation based on prior contributions and activity within Panoptic and Uniswap liquidity pools. Key features include multiplier incentives, where liquidity providers on Uniswap V2 will receive a 1.25x multiplier, liquidity providers on Uniswap V3 will receive a 1.5x multiplier, and early Panoptic users will benefit from a 1.75x multiplier. However, the effectiveness of these multipliers diminishes as users accumulate more PIPS. The campaign also features a cumulative boost, meaning users can stack their rewards, enhancing their overall benefits. Initially, the campaign will focus on the ETH/USDC and ETH/wBTC pools, both set at a 0.30% (30bps) fee.

Points Distribution, which determines rewards, follows a proportional distribution model based on several factors. Points are distributed in proportion to a user's share of the Total Value Locked (TVL), but users can be diluted as more participants join. The longer the duration of participation, the greater the accumulation of points. Points are also awarded based on the volume of option premiums paid or earned. The distribution breakdown allocates 52% of points to sellers, 30% of points to Panoptic Liquidity Providers (PLPs), and 18% to traders. For more details on how these points are calculated, please refer to the Panoptic PIPS example.

In addition to the PIPS campaign, Panoptic has held six different beta runs on various networks, including Optimism, Base, Avalanche, and Polygon. During these beta runs, prizes were awarded to the best traders, essentially functioning as trading competitions. These beta runs have helped to test and refine the Panoptic platform prior to the mainnet launch and the PIPS campaign.

Opyn has yet to launch a points-based campaign or introduce a token, and there are no current plans to do so. However, Ribbon Finance, arguably Opyn's #1 user, successfully executed a token airdrop campaign before migrating to AEVO. This case offers insights into the potential impact and structure of such initiatives.

The Ribbon Finance airdrop campaign distributed tokens to several groups of its userbase as well as to users of competitors' platforms to lure them to use Ribbon. The Ribbon Governance Token Distribution allocated 3% of its RBN token supply, amounting to 30 million RBN, to its community. 4 million RBN (13.3% of the airdrop) were allocated to users of existing Ethereum options protocols, including Hegic, Opyn, Charm, and Primitive, with each eligible address receiving 5,772 RBN.

Ribbon Strangle Buyers received a total of 0.5 million RBN, with each address eligible to receive 11,904 RBN. 10.5 million RBN were distributed to Theta Vault users, with each address eligible for 12,195 RBN. An additional 10 million RBN were distributed on a pro-rata basis to users of Ribbon's Option Vaults, based on their deposit amounts, with the median bonus for this group being 6,609 RBN.

5 million RBN were allocated to active Discord members who had sent more than five messages. Members could choose between receiving a Ribbon Hat or participating in the airdrop, with hat recipients awarded 62,500 RBN each and airdrop participants receiving 27,027 RBN each. For further details, please refer to Ribbon Finance's Airdrop Distribution.3Jane, a Ribbon Finance fork that launched in 2024, also uses Opyn as a base layer to mint options. It has launched Amplol, a liquidity mining mechanism that dynamically rebases based on TVL. As more users deposit, Amplol is minted to existing holders proportional to TVL, ensuring that early users retain their original proportional ownership of the token without dilution.

By making rewards a function of TVL, as opposed to time, early depositors are disproportionately rewarded the most since their Amplol earned scales with the TVL, as opposed to punishing them through time-based dilution. This creates an interesting game theory dynamic in which the user is incentivized to deposit early.

These examples demonstrate the potential effectiveness of token distribution campaigns and liquidity mining mechanisms in attracting users and incentivizing early participation within the Opyn ecosystem. While Opyn itself has not implemented such initiatives, the success of Ribbon Finance and 3Jane highlights the potential benefits of these strategies for driving adoption and liquidity.

To understand the significance of GMX's Incentive Structure, it is essential to recognize the following key developments. GMX was originally known as Gambit and later as XVIX before it migrated to Arbitrum. Instead of having GLP, GMX had USDG, a stablecoin pegged to the dollar and facilitated margin trading. However, USDG was eventually phased out, existing only on the Binance Smart Chain (BSC) under Gambit. During 2021, the team decided to merge all tokens and migrate to Arbitrum, abandoning Gambit and XIVX and focusing solely on GMX.

Upon migrating to Arbitrum, GMX introduced a comprehensive liquidity mining campaign with incentives for GMX-USDG and USDG-USDC pairs. The GMX-USDG pair offered 50,000 GMX tokens per month and 100,000 vested GMX tokens per month, while the USDG-USDC pair provided 10,000 GMX tokens per month and 20,000 vested GMX tokens per month. In addition to these incentives, a bonding mechanism was introduced to strengthen the USDG peg to 1 USD, allowing participants to purchase bonds using USDG, locking the tokens, and receiving bond tokens in return. This approach was designed to enhance the resilience of USDG and ensure stability within the ecosystem.

As part of the ongoing strategy, GMX has the flexibility to modify vested GMX rewards to align with market conditions and strategic goals. The proposed adjustments include 75,000 vested GMX rewards for the GMX-ETH pair, 50,000 vested GMX rewards for GLP, and 50,000 vested GMX rewards for single-token GMX staking.

GMX's deployment on Arbitrum also allowed users to complete 10 out of 14 actions required to qualify for the Arbitrum airdrop, emphasizing the campaign's "composability" and making it easier for participants to qualify.

By offering a comprehensive liquidity mining campaign and facilitating Arbitrum airdrop qualification, GMX positioned itself as a key player in the Arbitrum ecosystem, attracting users and liquidity to its platform during the early stages of Arbitrum's growth.

7. Fee Structures and Incentives

In the rapidly evolving landscape of decentralized finance (DeFi), protocols employ various fee structures and incentive mechanisms to attract liquidity, encourage user participation, and generate revenue. This section delves into the fee structures and incentives of Panoptic, Opyn, and GMX.

Panoptic employs a "Commission Fee," which is a fixed percent fee charged to buyers and sellers for opening a position. 100% of this fee is given back to Panoptic Liquidity Providers (PLPs), and there is no commission fee charged for closing a position.

Panoptic also utilizes a variable called "Vegoid," which acts as an input into the calculation for the liquidity spread multiplier. A higher spread is better for sellers and corresponds to a low vegoid, while a low spread is better for buyers and corresponds to a high vegoid.

Opyn's Squeeth and Convexity products currently do not charge any fees.

GMX distributes the fees paid by traders as follows: 30% accrue to GMX stakers, and 70% accrue to staked GLP. Fees are paid in the gas token, either ETH or AVAX.

Once GMX tokens are staked, esGMX is accrued. Users can then choose to either let their esGMX rewards compound and gain more fees or vest their esGMX tokens so that they're converted into GMX every second and will fully vest over 365 days.

When GMX is staked, it accrues Multiplier Points (MP) every second at a fixed rate of 100% APR. For example, 1000 GMX staked for one year would earn 1000 Multiplier Points. Multiplier points can be staked for fee rewards, thus earning compound interest. When GMX or Escrowed GMX tokens are unstaked, the proportional amount of MP is burnt. For instance, if 1000 GMX is staked and 500 MP has been earned so far, then unstaking 300 GMX would burn 150 MP.

The cost to open or close a position on GMX is 0.1% of the position size. If a swap is needed when opening or closing a position, then the regular swap fee would apply, which ranges from 0.2% to 0.8% of the collateral size, depending on whether the swap improves balance or reduces it.

8. Product Differentiation Among GMX Forks

GMX has been a highly successful product, leading to numerous forks of its codebase. According to DeFi Llama, there are over 60 forks of GMX. For this analysis, we narrowed it down to the top 12 forks at the time of writing, which included Kinetix, Fulcrom, KTX, Mummy, Phame, TsunamiX, QuickPerps, Morphex (and BMX), Alpaca, Thetys, and Cadence.

Many protocols start by forking GMX to quickly develop a basic working product. However, true innovation happens later when protocols add features that differentiate them. Nonetheless, most of the innovations are bound to trendy protocol forks with new features added. For example, Kinetix forked GMX for KinetixV1, but for KinetixV2, they added unique functionality inspired by GNS, allowing a single pool of assets to handle all trades, including forex. Morphex added an auto-compounding feature for GLP-style vaults and offers rewards as options. These are the types of features that set protocols apart.

Some protocols outsource specific functionalities. Quickswap, whose main product is a spot DEX, now utilizes Orderly's order book for perps trading. One of the most common codebase changes is switching the oracle from Chainlink to Pyth. Most forks have a UI very similar to the initial GMX UI, only adapting the colors to better fit the protocol/chain colors. One of the few common changes is adding a trollbox/chatbox and hiding the swap functionality, although the reason for this is unclear if the swap functionality is still present.

Kinetix is an all-in-one DeFi app with spot trading (forked Uniswap V3), derivatives (Perp V1 = GMX, Perp V2 = Gains Network-inspired), and AI chatbots. It uses Pyth and API3 as oracles. The UI/UX has no swap button (but functionality exists) and tools on the chart. Kinetix has run several Galxe campaigns.

Fulcrom offers a live feed for trades, added SHIB and DOGE to the GLP, and provides CRO token rewards (backed by Cronos Labs). It uses Pyth as an oracle. The UI/UX does not clearly display the funding rate. Cronos ran a Galxe campaign with Fulcrom-related quests.

KTX features bribes for the KTC/MNT pool on MerchanMoe (TraderJoe on Mantle) and offers 100x leverage (compared to 50x on GMX). The UI/UX includes charting tools, TP/SL on the main trading page, and highlights the liquidation price. KTX has been active on social media with Galxe campaigns, token giveaways, trading campaigns, and NFT contests.

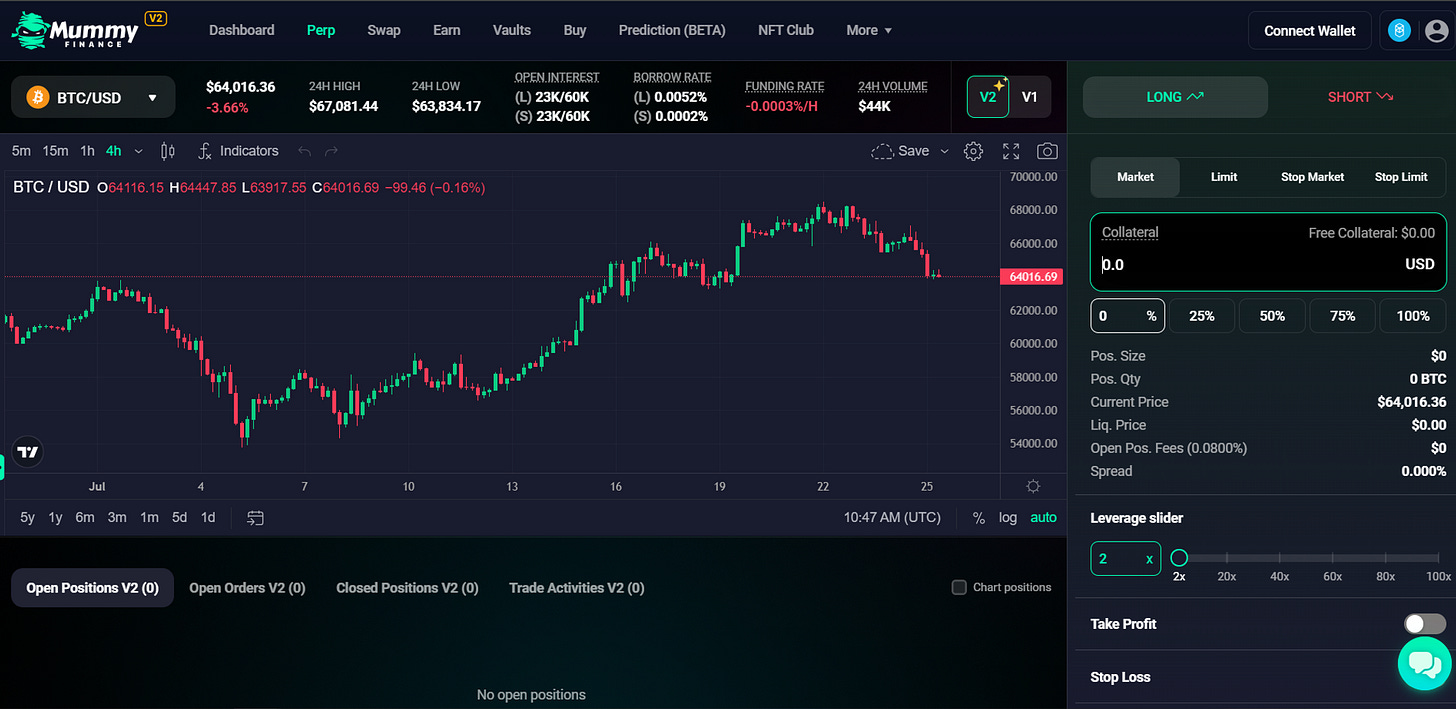

Mummy initially planned to integrate the Olympus DAO system (permanently protocol-owned MLP), but references were later removed from the docs. The UI/UX features a non-functional chatbox, repeated info between the banner and chart, and hidden charting tools. Mummy has been featured in the FTM Spotlight, participated in the Layer 0 airdrop, and held quarterly trading competitions.

Morphex offers BMX (Base Version) and Morphex (FTM version). The main differentiator is that Morphex allows users to wrap their LP tokens (MLP or BLP) as wMLP or wBLP using Yearn vault architecture, enabling auto-compounding of rewards. BMX Classic is the GMX fork, while BMX Freestyle uses Symmio. The UI/UX includes a market depth/orderbook chart due to the use of Symmio (RFQ). Morphex has been featured in the FTM Spotlight.

Phame's V1 was a GMX fork, while V2 introduced improvements such as separate long/short borrow rates and open/close fees for different tokens, fixing accounting bugs, and dynamic minimal profit-taking time based on position size. Phame has no swap functionality, requiring users to have the right collateral to long. The UI/UX is straightforward, and the project's social media presence appears to lack a clear strategy, with no trading competitions or Galxe campaigns.

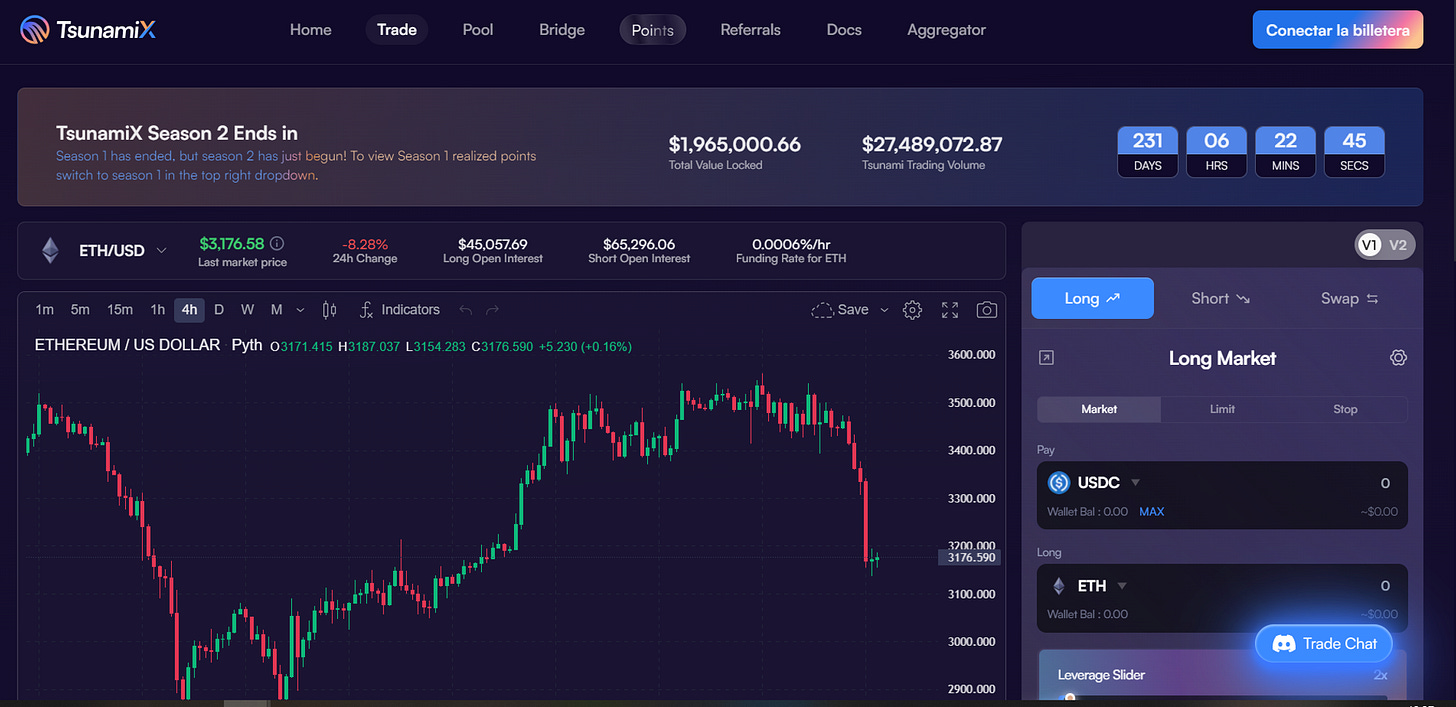

TsunamiX integrates Pyth for low-latency price feeds. V2's base contracts inherit audits from Vela Exchange, allowing long/short synthetic assets like BONK, WIF, or PEPE with TUSD as collateral. The UI/UX includes a V1 to V2 button (a bit hard to spot), tools on the chart, a chatbox (Discord), and swap functionality.

QuickSwap's V1 was a GMX fork with a few improvements, while V2 (Hydra) and V3 (Falkor) use Orderly Network for leverage trading of 39+ different popular crypto tokens. The current UI/UX is designed for V3 and the Orderly orderbook.

Equity forked GMX's GLP, but it acts as an index without the ability to trade perps against it. It functions as a USDC-FTM AMM, with the only active functionality being swaps between axlUSDC-lzUSDC-FTM. As an automated money market, the UI/UX elements were not applicable to perpetual exchanges.

Cadence's V2 (current version) features a decentralized network of keepers. The next iteration (V3) aims to be the first chain-abstracted perpetuals protocol, integrating into Cadence's intent-based execution network, Symphony, and utilizing Account Abstraction and intent-based architecture. The UI/UX is simple, with a default line chart. Cadence has held thread writing and trading competitions.

Alpaca integrates Pyth's price feed and offers 0-fee trading for 1 month after launch (for positions opened longer than 15 minutes). A portion of unutilized assets in the LP pool is redeployed into Alpaca lending vaults, generating further yields for LPs and making more assets available for LYF borrowing. The UI/UX uses more memory than other perp websites and includes Tradingview integration, CN translations, shareable referral links, live tracking of ALPACA trading rewards, and trading pairs as part of the URL. Alpaca has allocated a marketing budget for group/KOL AMAs, trading groups, and paid tweets from KOLs.

Tethys has not made significant changes to the product functionalities. The UI/UX has broken charts on some devices.

9. Summary: Protocol Feasibility & Fee Structures Analysis

Each of the candidate protocols presents unique trade-offs and requirements. GMX V1 and Opyn Gamma offer robust functionalities but come with specific development needs. Gearbox, while innovative, requires a competitive yield-farming ecosystem not currently available on Harmony. Protocols like GMX V2, Synthetix V2, and Synthetix V3 are dependent on pull oracles, which are not yet available. Gains Network and Perpetual Protocol have specific asset and market-making requirements that add complexity to their deployment. The excluded protocols were deemed unsuitable due to their dependencies and licensing issues.

In terms of fee structures, Panoptic charges a fixed "Commission Fee" for opening positions and uses a variable called "Vegoid" to calculate the liquidity spread multiplier. Opyn's products currently do not charge any fees. GMX employs a more complex fee distribution system between stakers and liquidity providers, along with a unique Multiplier Points mechanism to incentivize long-term staking and reward users with compound interest on their fee rewards.

The GMX forks have introduced various differentiations. For instance, Kinetix added unique functionality inspired by GNS, allowing a single pool of assets to handle all trades, including forex. Morphex introduced an auto-compounding feature for GLP-style vaults and offers rewards as options. These innovations, along with changes in UI/UX and oracle usage, set these protocols apart. The forks also vary in their marketing strategies and community engagement, with some actively running Galxe campaigns and trading competitions to attract users.

This diversity in approaches highlights the potential for innovation and differentiation within the GMX ecosystem, allowing each fork to carve out its own niche and attract a specific user base. The evaluation underscores the importance of carefully assessing the feasibility and requirements of each protocol to ensure a successful deployment on a new chain. It also emphasizes the need to consider the unique features, fee structures, and community engagement strategies of each protocol to maximize their potential.

10. GX.country: Harmony’s GMX Fork

This section outlines proposed changes to the GX.country protocol's tokenomics with the goal of creating a self-sustaining, perpetual system that incentivizes user engagement and long-term growth. Our analysis focuses on the distribution of trading fees, a comparison to existing models, and different approaches to attract traders while ensuring its sustainability.

Current GMX Model Limitations

GMX and with that, most GMX forks, distribute trading fees with 70% allocated to Liquidity Providers (LPs—GLPs) and 30% to GMX stakers (governance). Morphex, a GMX fork that didn't follow this rule, adjusts this distribution by allocating 90% of fees to LPs under certain conditions but with significant complexity and risks for users.

More on Morphex: 60% of the fees are directly allocated to LPs in the platform (BLT). 30% of the fees are allocated to LPs on Aerodrome on the wBLT-BMX pool. 10% of the fees are allocated to BMX staking. BMX is the equivalent of GMX. wBLT is a liquid wrapper of BLT, the equivalent of GLP. So that users who were providing liquidity on Morphex (BLT) and were also LPs on the wBLT-BMX pair could earn up to 90% of the protocol revenue. To capture 90% of revenue, users must interact with BLT, wBLT, BMX, and their impermanent losses on Aerodrome, as well as be counterparty to Morphex trades. Aerodrome LPs earn $AERO, not trading fees. $AERO distribution is determined by $veAERO holders every epoch (7 days), who are rewarded with 100% of protocol fees.

Proposed GX.country Fee Distributions

The GMX V1 approach—Base Case allocates 70% to LPs, 30% rebate to traders, with no significant difference in user incentives compared to GMX.

The GMX V2 approach distributes 60% to LPs, 30% rebate to traders, and 10% to protocol sustainability.

The GX.country approach allocates 65% to LPs, 25% as a rebate to traders, and 10% to a trading competition. This structure incentivizes trading by double rewarding traders directly and discouraging unproductive activities like arbitrage and funding rate farming. The competition prize pool is divided among the top 10 traders based on their profit and loss for each epoch. Depending on the pool size, the number of rewarded traders may increase to 20 or 50. Additionally, to further incentivize active platform usage, specific requirements for traders to qualify for the discount can be implemented. For example, a minimum trading volume of $1,000 per epoch and a minimum of 10 trades could be enforced.

A more aggressive trading competition strategy that competes with GMX on the fee side allocates 70% to LPs and 30% to larger trading competitions. This distribution maintains the same LP incentives as GMX V1 but shifts the entire GMX token allocation to more substantial trading competitions. By offering larger prizes, this approach aims to attract more traders and generate higher trading volumes. The trading competitions can be structured similarly to the the previous GX.country approach, with rewards distributed based on profit and loss rankings and potential minimum trading requirements to qualify. This alternative focuses on creating a highly competitive trading environment to drive user engagement and protocol growth, potentially attracting top traders from other platforms.

11. Analysis of the Fee Distribution Impact

GMX Data

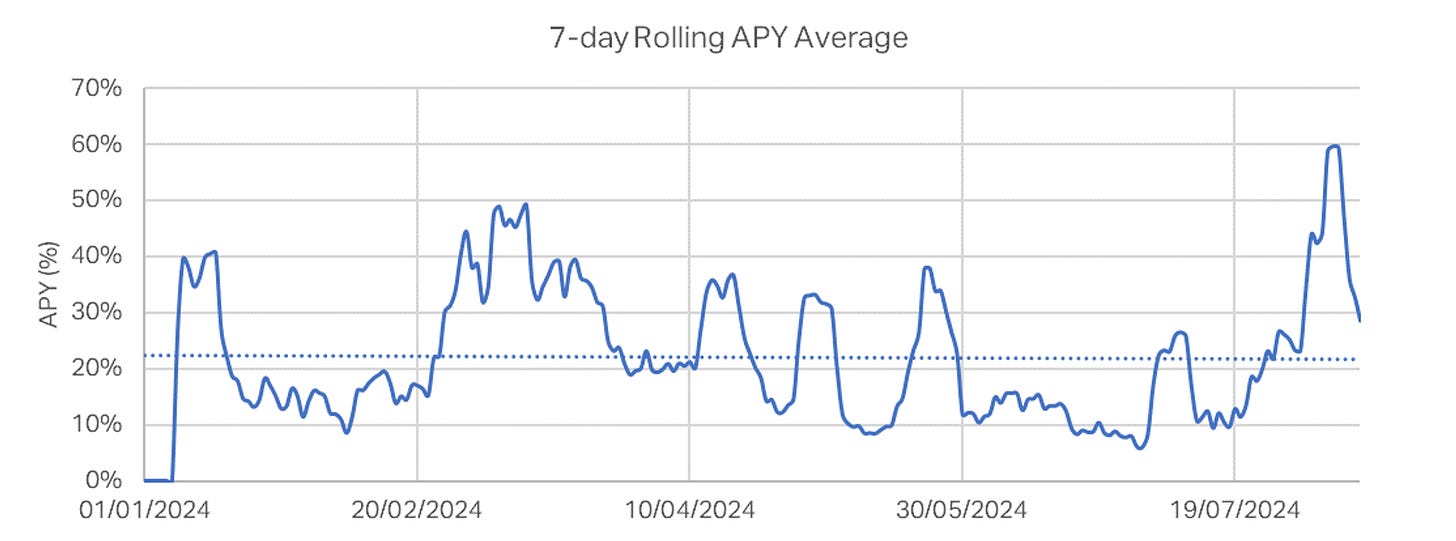

GMX YTD data (January-August.2024) suggest that GLP users are earning around a 23% APY.

Despite TVL going down, it was assumed that offering 20% would not be enough to convince LPs to bridge and use a new protocol. Therefore, traders would need to receive outsized returns compared to GMX.

Additionally, it was assumed that 20% is the bare minimum in terms of opportunity costs given the risks associated with being a liquidity provider on GMX, assuming an efficient and rational market. One of the key support points for that argument is that despite GMX V2 launching and the overall DeFi space evolving, there's still close to $100m in AUM on GMX as GLP.

A correlation exists between earned fees and TVL. Since fees are derived from trading volume, a similar correlation can be observed between volume and TVL—not depicted. A larger TVL typically indicates that there are larger trading caps, thus larger positions can be traded and, consequently, higher fees.

An analysis of fees as a percentage of trading volume for the year 2024 indicates an average rate of 0.175% per $1 in volume. It's important to note that this figure represents a mean value within a range that fluctuated between a low of approximately 0.085% and a high of roughly 0.695%. The high fee days come from low volume days, where we assume that a lot of positions are closed, hence generating fees without generating volume.

Analysis of the past 6 months' data reveals that the top 30 wallets, representing just 0.7% of all 4,290 wallets reported on Dune, account for a staggering 80% of the platform's total trading volume. Notably, these few actors are trading in significant amounts, with the top two wallets alone responsible for 15% of the total volume each. This highlights the concentration of trading power among a small group of traders.

12. Proposed Changes

The split of 65% to GLP, 25% as a rebate to traders, and 10% as a trading prize is used as a baseline. The percentage allocated to each stakeholder will be adjusted pro-rata to ensure 100% of the fees are distributed.

The baseline assumptions are that LPs will provide $1 million in liquidity, which is assumed to remain constant. LPs aim to make $100,000 per year on fees, implying a target APY of 10%. They are considered insensitive to the actual APY. Based on GMX data from 2024, the average trading fee is assumed to be 0.175% per $1 in volume.

Table 1 illustrates that for the baseline case, a daily volume of approximately $240,000 would be required to generate a $15,000 trading competition once a year. Traders would receive an additional $38,000 as trading rebates. The effective trading fee in this scenario would be 0.131%.

An additional assumption is made to consider a scenario where the yearly volume is capped at $1 million, regardless of the reward distribution.

Table 2 presents this scenario, where the protocol would generate a modest $1,750 in fees, with $1,137 allocated to LPs, $438 as rebates, and $175 for the trading competition. This would result in an approximate APY of 0.114% for LPs. While there is always the possibility of a bull market driving a 100x increase in volume, raising the APY to 11.4%, a 25% fee rebate for traders remains feasible without compromising the competitiveness of the LP offering.

The 65/25/10 or the 70/20/10 splits provide a well-balanced fee distribution between LPs, Traders, and the protocol vision. However, to reach a 30% APY—assuming this is outsized enough to attract GMX LPs and the rebate and competitions are good enough to attract traders—GX.country would need to hit roughly $260m+ in yearly volume, assuming there's only $1m in liquidity.

While achieving an average daily volume of $720k for a year seems attainable, GX.country faces challenges beyond just offering lower fees or having a better or different product. Attracting users requires more than just cost competition, especially against established players like GMX. Additionally, market maker integration and potential airdrop opportunities in larger ecosystems could be drawbacks for GX.country.

13. Conclusion

As the DeFi landscape continues to evolve, Harmony's approach to building its derivatives ecosystem will need to remain flexible and responsive to market demands and technological advancements. The proposed GX.country fork of GMX presents an opportunity to create a unique offering tailored to Harmony's ecosystem. However, success will depend not just on technical implementation and tokenomics, but also on the ability to attract and retain users in a highly competitive landscape.

The challenge lies in offering compelling incentives while ensuring long-term sustainability and fostering genuine engagement beyond yield farming. As the DeFi landscape continues to evolve, Harmony's approach to building its derivatives ecosystem will need to remain flexible and responsive to market demands and technological advancements.

By leveraging the lessons learned from established protocols and innovating where possible, Harmony has the potential to carve out a significant niche in the growing world of DeFi derivatives.

Three Sigma is a Web3 engineering, research, and investment firm. They work with DeFi and NFT protocols to enhance security, optimize designs, and ensure long-term success through code audits, risk analysis, and advisory services.”