Q3 2025: London & Berlin Forks ⚡, Stream Sync Dashboards 🌊, LP Bots 🤖, Beta Governance 🗳️

September was a month of steady progress across protocol, product, and governance. On the protocol side, multiple PRs improved stream sync stability, optimized epoch pipelines, and advanced the London fork through devnet and testnet deployments. At the product layer, the team refined LP bots and backtesting tools with impermanent loss tracking, grid-style strategies, per-transaction fee verification, and IRR calculation fixes — aligning backtests more closely with production data. Governance took a leap forward with the launch of gov.harmony.one, and validator quorum updates, while community channels stayed active with newsletters, shorts, and weekly recaps.

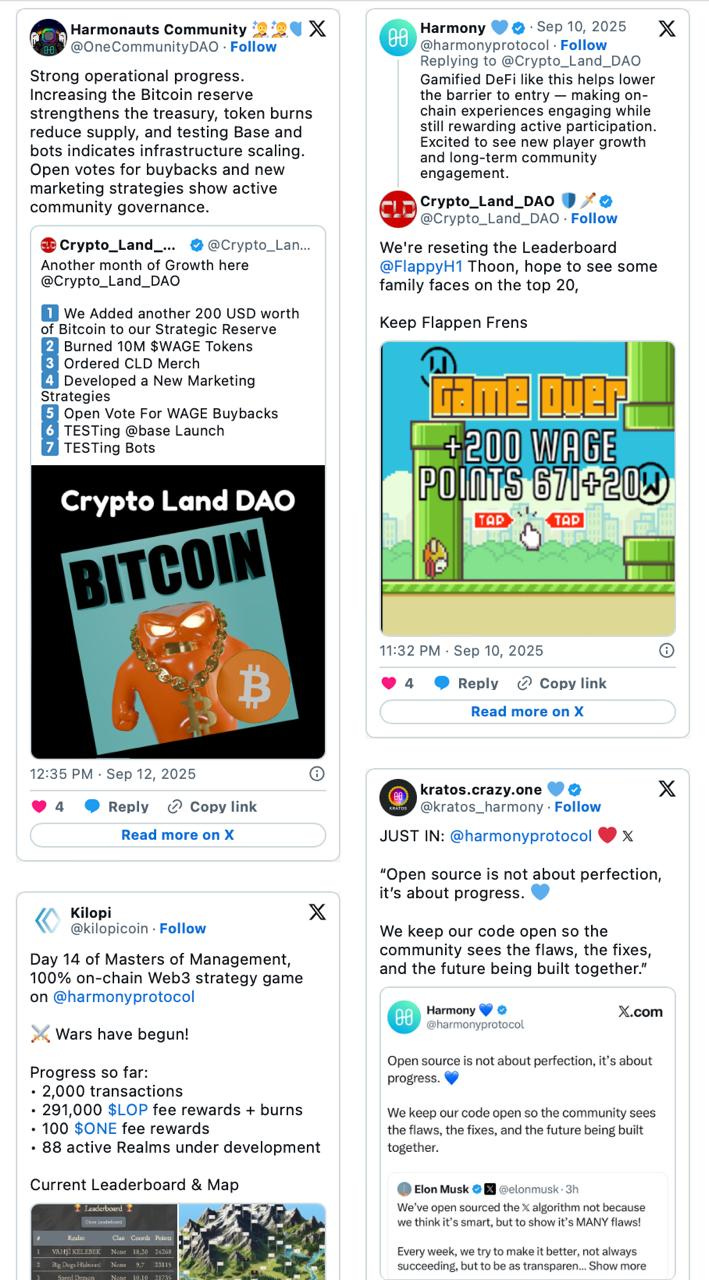

The Harmony ecosystem also saw strong community engagement, with DAOs driving treasury growth, buyback votes, and token burns, and Kilopi’s Masters of Management game crossing 9,000 transactions and 100+ active realms. Validators shared guidance to onboard new stakers, while builders and players experimented with new strategies, games, and governance proposals. Together, these updates highlight Harmony’s focus on mainnet upgrades, DeFi strategy tooling, and community-driven governance heading into Q4.

Week of Sept 1st

September opened with major strides across debugging, analytics, and governance. Aaron built a timeline tool to visualize wallet activity and fix swap fee timestamp issues, giving clearer insight into multi-position strategies. Artem expanded the LP bot to calculate real wallet earnings and impermanent loss, backed by archival node data. Frank fixed core bugs in backtesting logic — from tick ordering to APR methodology — and tuned strategy parameters to align more closely with production results. On the protocol side, Gheis merged PR #4940, making stream sync faster and more reliable, while adding an optimized epoch sync pipeline. Yuriy deployed the initial version of gov.harmony.one.

Crypto Land DAO kept momentum with weekly updates, WOODEN onboarded new members through WAGE giveaways, FlappyH1 rewarded its latest winner, and Validator.ONE shared tips on choosing validators for fairer staking rewards. Kilopi’s on-chain game “Masters of Management” also gained traction with active clans, hundreds of transactions, and fee rewards in ONE.

Top 3 Progress

Gheis: Deployed PR #4940 across all testnet/devnet nodes, boosting stream sync speed and stability; introduced a lightweight sync pipeline for epoch chains.

Artem: Enhanced the LP bot with impermanent loss tracking, net APR stats, and archival-node-based wallet earnings.

Frank: Fixed backtesting bugs in Aerodrome pools, improving accuracy of fee accrual and aligning strategy parameters with production bot performance.

Week of Sept 8th

Week two focused on governance, LP strategies, and stability upgrades. Aaron fixed liquidity-to-USD and earnings calculations to tighten backtesting reliability. Artem advanced grid-style liquidity experiments with threshold rebalancing to cut impermanent loss. Frank built scripts to validate fee attribution across mint/burn cycles, comparing real on-chain data with backtests. Gheis and Ulad delivered PR-4943, stabilizing stream sync and cleaning up crosslink processing, while Konstantin deployed the London fork on devnet and debugged 1-second finality issues. Yuriy updated SnapshotX quorum logic and improved Aerodrome indexing, Rikako studied delta/gamma hedging, and Theo identified grid-style 100-tick strategies as consistently profitable. Alaina kept community updates flowing through shorts, threads, and research on hedging derivatives.

Crypto Land DAO reported another month of treasury growth and launched new buyback votes, with Harmonauts DAO highlighting the momentum. Harmony spotlighted gamified DeFi through FlappyH1’s leaderboard reset, and Kratos emphasized open-source transparency. Kilopi’s Masters of Management reached 2,000 transactions and 88 active realms as wars began, while token burns and rewards drove further engagement.

Top 3 Progress

Gheis: Fixed crosslink sync issues in PR-4943, added error handling, and boosted testnet/devnet stability.

Aaron: Resolved liquidity and earnings data inconsistencies, ensuring accurate backtesting.

Artem: Tested grid-based liquidity strategies with smarter rebalancing to reduce IL.

Week of Sept 15th

Week three centered on data accuracy, wallet strategy analysis, and protocol stability. Aaron overhauled earnings scripts to fix attribution errors, refine IRR calculations, and improve fee tracking across mints and burns. Frank expanded historical position tracking to fully capture liquidity and fee flows, while Rikako and Theo analyzed top wallets, surfacing grid-style 100-tick strategies and testing timeline tools for more precise IRR. Philipp built faster wallet-profitability tools, and Alaina published DeFi threads, shorts, and the Q3 draft. On infra, Gheis shipped PR-4947 to fix RLP decoding errors in stream sync, Konstantin launched the London fork on testnet, and Ulad advanced crosslink monitoring.

On the community front, Crypto Land DAO added to its BTC reserve, burned tokens, and pushed new buyback votes. Kilopi’s Masters of Management passed 4,000 transactions and 100+ active realms with its first defensive victory. Validators shared insights on robotics and decentralization, while builders were invited to shape DeFi proposals via Snapshot.

Top 3 Progress

Aaron: Fixed liquidity-to-USD and fee attribution issues, strengthening IRR and earnings calculations.

Gheis: Delivered PR-4947, resolving critical RLP decoding errors and stabilizing stream sync.

Frank: Built full historical position tracker to capture liquidity flows and validate fee calculations.

Week of Sept 22nd

Week four brought big steps in tooling, data validation, and governance. Aaron fixed IRR calculations and streamlined receipt fetching, cutting down event loads and improving reliability. Frank and Artem advanced position tracking, building per-transaction verification and aligning fee collection directly with pool data. Philipp tested the bot wallet with external APIs, showing the strategy’s weakness in volatile BTC markets, while Rikako and Theo refined XIRR/APR calculations and synced results across tools. Alaina wrapped the Q3 newsletter, filmed the weekly recap, and launched assets for the governance beta release. On infra, Gheis advanced trusted peer integration and debugging crosslink issues, Konstantin finalized London fork work, and Ulad deployed new devnet servers, stream sync upgrades, and subgraph adjustments.

Community stayed active: Crypto Land DAO expanded its BTC reserve, burned tokens, and highlighted governance as core to Harmony’s future. Kilopi’s Masters of Management hit 9,400 transactions and launched Clan Clashes with 113 active realms. Validators shared wallet setup guides, helping new users stake ONE with ease.

Top 3 Progress This Week

Theo + Yuriy: Finalized the launch of gov.harmony.one

Artem + Frank: Delivered per-transaction fee verification and aligned position tracking with pool events, improving backtest reliability.

Ulad: Deployed new devnet servers, integrated stream sync with Berlin/London fork changes, and optimized Aerodrome subgraph setup.

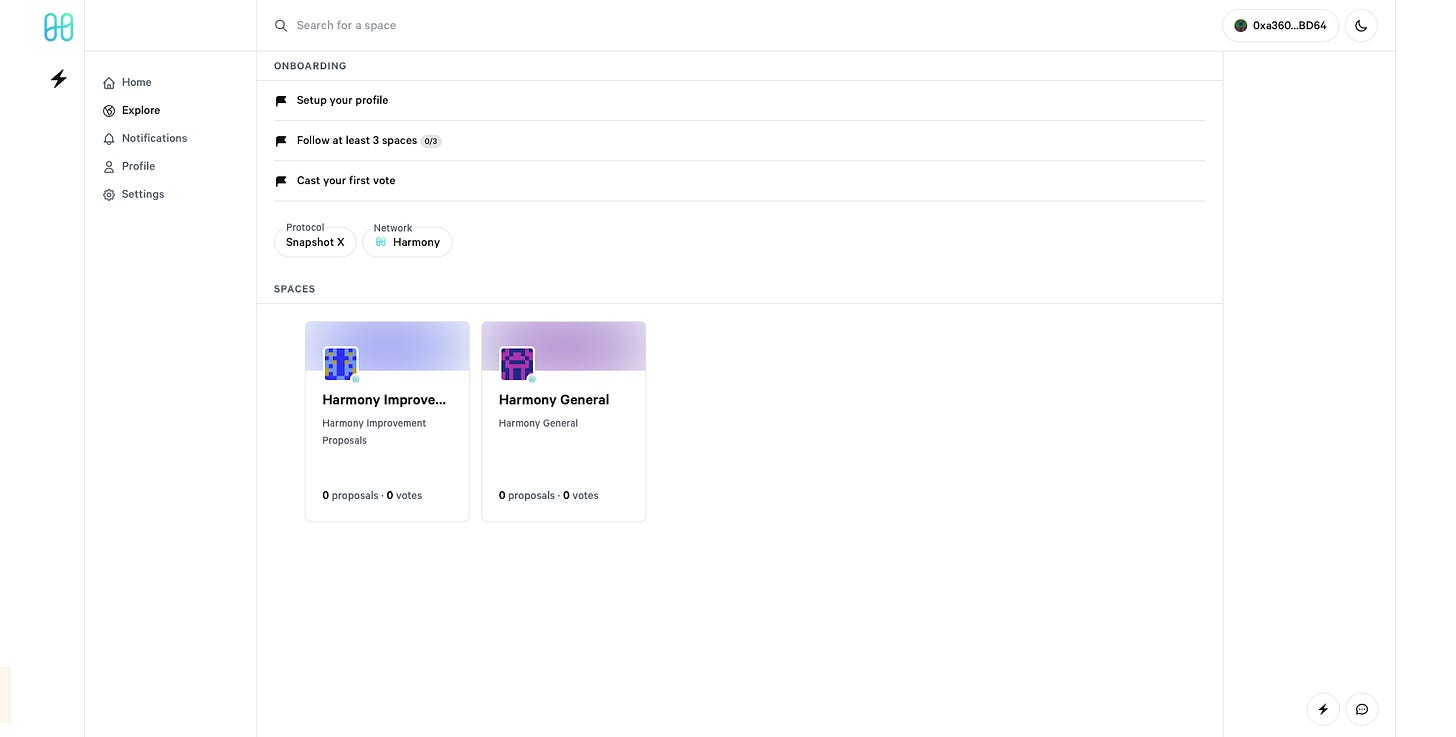

Beta governance is here! 🎉

A hybrid of on-chain + off-chain voting, with more upgrades on the way 🗳️

Explore governance → gov.harmony.one

Q3 Team Progress

In Q3, Harmony advanced protocol upgrades with the London and Berlin forks, new Ethereum proposals (EIP-1153, EIP-2537, EIP-2935), and Stream Sync stability improvements, bringing the network closer to one-second finality and full Ethereum compatibility. Infrastructure upgrades and real-time dashboards strengthened visibility and readiness for mainnet launches in Q4.

On the product and community side, we launched the Aerodrome Monitoring Service, refined LP bots and backtesting systems, and delivered the new Governance platform with validator alignment and recovery proposals. Consistent marketing and community growth across X, Substack, and YouTube reinforced these technical milestones, setting the stage for stronger DeFi strategies and governance in Q4.

Protocol & Platform

⛓️Konstantin Potapov

During Q3, I tested the London and Berlin fork release compatibility. The release passed validation on devnet and testnet and was partially deployed on mainnet. It introduced more than 15k lines of code changes and revised EVM internals by replacing big.Int with the more efficient uint256.Int to align with Ethereum’s implementation, updating Harmony smart contracts to match EVM rules, adding the BASEFEE opcode, and adjusting gas computation for several built-in functions. I also implemented transient storage (EIP-1153) and confirmed its execution on devnet. This feature requires additional modifications introduced in the 1.11 fork (Shanghai), including a writable data location with transaction-scoped lifetime, load and save functions integrated into the state transition, and dedicated opcodes supporting transient semantics.

Q4 Plan: I’ll launch release with transient storage (EIP-1153) on mainnet. I’ll also improve metrics coverage for the block proposing process, including more precise block proposal timings under 1-second finality.

♏️Gheis Mohammadi

In Q3, I delivered beyond my plan with three major upgrades.

EIP-2537: fully implemented BLS12-381 precompiles (~17k LOC), enabling efficient on-chain BLS verification for consensus, threshold crypto, and zk apps. Key challenge was adapting complex math at the EVM level and refactoring mid-spec update, which reinforced modular design practices.

EIP-2935: built a ring buffer to extend block hash history 32x, improving access to older block data. The main challenge was balancing storage efficiency with backward compatibility. Implementation is complete, pending team updates and rebase.

Stream Sync: delivered stability upgrades in validation, peer management, and crosslink handling. Deployed successfully on devnet and testnet, now ready for Q4 mainnet launch.

I also contributed smaller PRs for bug fixes, error handling, and P2P syncing performance.

Q4 Plan: launch Stream Sync on mainnet with backward compatibility, finalize EIP-2935 to latest Ethereum spec, and implement new EVM opcodes as needed to maintain full Ethereum compatibility.

🤲Ulad Muraveika

My main focus was stream sync. I deployed new versions on devnet/testnet, debugged database and crosslink issues, and worked with Gheis on fixes that eventually landed in merged PRs. To make issues visible, I built detailed visualizations: real-time dashboards for stream sync health and crosslink messages. These gave the team clear visibility into synchronization behavior and helped validate improvements after each release.

In parallel, I broadened my operational experience: setting up and maintaining devnet/testnet infrastructure, learning how to support a Base archival RPC node with reth, and improving disk and server management for Erigon/Lighthouse.

Q4 Plan: I’ll review the current infrastructure and costs, because now I’m the only one in charge for this. I’ll also improve our observability stack - review and fix our current setup and add new metrics and tools. Lastly, with the team, I’ll prepare the stream sync alpha release on mainnet.

Product & Tools

🌻 Yuriy Menkov

I verified Aerodrome Base data (fees, datasets) and launched the Aerodrome Monitoring Service, aggregating event/subgraph data into wallet- and position-level stats. Results were validated against Dune and custom transaction-level checks. A 3-month analysis showed the highest APR from short, narrow-range positions (often <1 hour), while most profits came from staking. Challenges included mismatches with Dune, differing IL calculations, and difficulty detecting hedged strategies.

I also led the migration and launch on Harmony — deploying contracts, launching the API, updating the UI, and adding features like validator whitelists, two-stage voting, staking dashboard integration, and customizable quorum rules.

Q4 Plan: advance analytics for IL, profit, IRR, and strategy search; expand the Aerodrome Monitoring Service with UI and real-time bot/wallet comparisons; and continue improving gov.harmony.one with features like automatic low-activity validator exclusion and governance integration in staking.

🚎 Artem Kolodko

In Q3, I developed and refined a new LP strategy for the cbBTC/USDC Aerodrome pool, adding rebalancing logic, hedging integration, and support for narrow tick ranges. I implemented the strategy in our bot, handling out-of-range positions, adding persistence for tracking, and improving reliability with multicall transactions, slippage checks, and bug fixes. By September, I expanded stats with IL tracking, net APR, and PnL metrics, and tested live deployments on fly.io. I also evaluated grid positions, concluding they reduce IL but also fee potential, with limited upside beyond gas savings.

Q4 Plan: Finalize return verification tools from blockchain events (IL, APR, USD returns), identify and analyze top LP wallets, and optimize our bot for a consistent ~30% APR. I’ll build a copy-trading bot for leading wallets, refine hedging with dynamic thresholds for volatility, and deploy across multiple cloud providers with monitoring and Telegram alerts.

🧙 Frank Egloff

I refined and validated the Aerodrome LP backtesting system against production data, implementing the Defilab methodology with feeGrowthGlobal0X128 for precise fee calculations and refactoring the position class to be pool-agnostic across Uniswap and Aerodrome. I added liquidity unit calculations to replicate feeGrowthInside behavior and resolved tick calculation bugs.

I built strategy-driven backtesting with volatility-based rebalancing triggers, unified TSV exports, and partial AERO rewards logic (blocked by Analytics API limits). I analyzed discrepancies between Aaron’s database and subgraph feeUSD data—his captured 7–11% of transactions but 43–83% of reported fees—traced to monitoring frequency mismatches (10-min production vs. hourly backtests).

I also began developing a Position Tracking System to study market participant behavior (tokenId tracking, rebalancing patterns, gas costs, timing) to optimize strategies and better understand position lifecycle dynamics.

🧸 Alaina Furstenberg

This quarter, I focused on consistent marketing, publishing weekly Twitter threads, progress shorts, and monthly Substack newsletters. I designed announcement assets, recap videos, and community updates, while coordinating co-marketing campaigns with Travala, CryptoLand_DAO, AthleteFi, FlappyH1, and validators. I expanded our research-driven content by distilling DeFi insights from academic papers and industry blogs into accessible threads, covering topics like asymmetric hedge ratios, delta-neutral LPs, dynamic hedging, futures-based ETFs, and reinforcement learning for liquidity management. I also scripted and produced shorts, finalized the July, August, and September newsletters, and packaged team milestones into recap materials.

Across X, Substack, and YouTube, our content cadence remained steady with weekly posts. On X, we drove 730.5K impressions and 38.4Kengagements (+12%), including 674 replies (+7.8%), with the engagement rate climbing to 5.2% (+12%).

On Substack, we maintained 24,300 subscribers (0% change) while article views rose 13% to 25K; our July and August pieces averaged 9.3K views with 24% open rates.

On YouTube, performance surged as a result of more consistent posting: the channel reached 14,500 views (+237% vs. prior 90 days) and 118.7 hours of watch time (+48%). Long-form videos continued to deliver steady engagement with 32K impressions, while short-form content broke out with 12.5K views (+566%), including 5.7K engaged views, meaning audiences watching beyond the first few seconds.

Q4 Plan: I will continue maintaining a consistent publishing cadence across X, YouTube, and Substack while deepening my understanding of DeFi strategies through ongoing research. I will test new products as they launch and create demos that showcase their impact to the community in clear and engaging ways.

🐝 Amanda Bancroft

During Q3, I joined the social media team and dove in with a 4x increase on daily X content contributing to a quarter close with increases over Q2 in engagements (25%), impressions (19%), profile visits (10%), replies (25%), likes (13%), and bookmarks (6%). The consistency strengthened Harmony’s visibility and community interaction.

On the operations side, I focused on budget review and revisions spearheading a Q3 with a 38% decrease in expenses over Q1, creating meaningful runway efficiency. I also managed state and federal regulatory filings, prepared documentation for R&D tax credit evaluation, and advanced groundwork for year-end compliance by initiating business reporting; positioning the company for a smooth year-end close.

Q4 Plan: I look forward to finalizing R&D tax credit documentation, state and federal tax completion, and closing out business censuses and filings. I will continue driving engagement with the Harmony community via X initiatives and increased output, experimenting with new content formats, as well as, collaborating with teammates to amplify reach and impact.

Community & Development

💹 Phillip Petzka

Q3 was focused on understanding and providing concentrated liquidity for cbBTC/USDC on Aerodrome, as well as the entire environment surrounding it. I improved my data analysis skills, wrote the first Dune queries to gather pool data, fees, position APRs etc. and worked with cursor to gather data via python scripts. It helped me to analyze wallets and thoroughly understand their strategies. Additionally, I assisted the team in understanding mechanics around concentrated AMMs and developing the LP bot on a theoretical level. It lead to an outperformance of the bot strategy during times of low volatility (appr. 70% APR), which is a great first success towards reaching the goal of a market-neutral average 30% APR return. However, it turned out that during high directional volatility, the strategy suffers losses due to frequent rebalancing.

⚽️ Theo Perisic

In Q3, I led and launched the new Harmony Governance platform, adding validator CLI voting, HIP/General spaces, and restoring delegator alignment to validator votes. I drove planning for the governance team, iterated the Accelerated Recovery Proposal with validators, and simplified it by leveraging the Validator Staking Initiative while removing short-term bonuses.

On DeFi, I analyzed Aaron’s LP data (05/01–08/01) to identify grid strategies in cbBTC/USDC CL-100. Results showed best performance either from a single incentivized 100-tick or a compact 5-band grid (~10–15% coverage), with adaptive execution depending on incentives, volatility, and Slipstream cycles. I also delivered on-chain pricing and LP performance infra, building swap pricing scripts, updating valuation logic, and reconciling Dune discrepancies.

Q4 Plan: enhance Harmony Governance with opt-in/opt-out features and a 33% network stake threshold, finalize the Accelerated Recovery Proposal for vote with a 1-year claim window, and apply wallet analysis to deploy a BTC strategy targeting 40%+ returns.

🍓 Rikako Hatoya

I extended the Portfolio Manager (Aerodrome bot) by adding options backtesting, Aerodrome/Uniswap compatibility, cbBTC/USDC fee integration, and AERO rewards tracking. I improved LP position handling (staked/unstaked), added functions for liquidity/fee management, RPC fallbacks, unit tests, caching, logging, and a getStats() API.

I built a multicall close workflow for Aerodrome LPs to bundle liquidity removal, fee collection, and LP burns into one atomic transaction, reducing gas and failures. I also developed hedging simulations using Revert.finance, Binance API, and Hyperliquid, calculating PnL, liquidation, and capital efficiency.

For wallet analysis, I ran backtests, created a Dune query to cross-check fee data, and explored IRR/APR methods to study profitable strategies.

Q4 Plan: establish verified baseline wallets with archival/subgraph/Dune cross-checks, and build tooling for APR/IL calculations and strategy backtesting.

Q4 Focus

In Q4, Harmony’s protocol team is focused on mainnet stability and Ethereum alignment. Key priorities include launching transient storage (EIP-1153), deploying Stream Sync to mainnet with backward compatibility, finalizing EIP-2935, and implementing new EVM opcodes. Alongside this, the team will strengthen infrastructure and observability with improved metrics, dashboards, and cost-efficient node management to support one-second finality and reliable cross-chain performance.

On the product and community side, the emphasis shifts toward sustainable DeFi strategies and governance maturity. Aerodrome bots and backtesting systems will be refined for APR, IL, and wallet-level return verification, with copy-trading and hedging automation under development. Gov.harmony.one will expand with continuous improvements like opt-in voting and finalized recovery proposals. Meanwhile, consistent content to X, Youtube, and Substack will keep Harmony’s community engaged. Together, these initiatives position Harmony to deliver stronger infrastructure, transparent strategy tooling, and a more resilient ecosystem for users and validators.