October 2025: Backtests to Bots 🔁, Stream Sync for Mainnet ⚡️, Copy-Trading Deployed 🪞

October was a focused month of engineering progress for Harmony. The team turned September’s LP wallet research into production-grade backtests with real swap fees, impermanent loss, and tick-width experiments, leading to the deployment of the BTC LP-hedger. Stream Sync advanced toward mainnet with leader-based strategies and early-exit logic for faster synchronization. Copy-trading evolved from historical replays to live wallet mirroring through rebalancer and multisig integration, while ops modernized node infrastructure with Goja tracing and Loki crash logging.

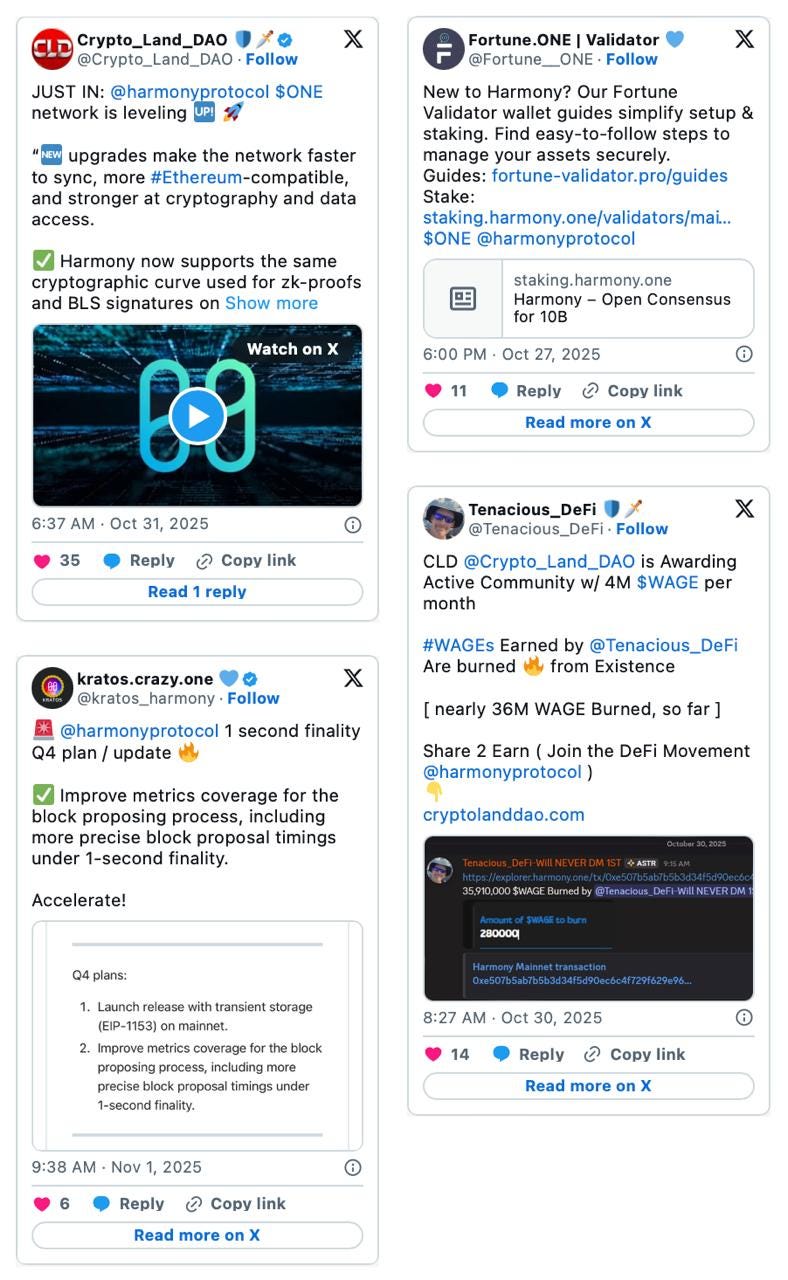

Across the ecosystem, community builders stayed active. EasyNodePro expanded to over 14,000 delegators with new $ENP staking rewards, Crypto_Land_DAO ran weekly FlappyH1 airdrops and promoted Harmony’s Stream Sync and EIP-2935 upgrades, and projects like Kilopi and AthleteFi continued to drive Web3 gaming and sports. Together, these projects kept excitement high for Q4’s mainnet and DeFi milestones.

Week of October 1st

We opened October by unifying price sources and return methods across the team. Aaron fixed token ID traceability in the timeline tool, while Artem and Yuriy standardized cbBTC pricing using the closest swap to mint or burn. Rika verified data accuracy at the block index level, and Theo finalized four XIRR and HODL models showing that true HODL gives a tighter benchmark than simple APR.

On the community side, EasyNodePro took over operations for the StrongMindsHold validator, growing to over 14,000 delegators with $1.7M staked. Bonus $ENP rewards launched across StrongMindsHold, RockTheBlockchn, and EasyNodePro validators, strengthening Harmony’s staking network.

Top 3 Team Progress:

Aaron: Fixed token ID traceability in ClaimRewards in the timeline tool, plus re-verified recollected data to close gaps for later backtests.

Artem: Implemented cbBTC price lookup from the nearest Aerodrome swap to every mint/burn, giving everyone a single, accurate source of IL inputs.

Rikako: Combined everyone’s cbBTC prices (mint → closest swap before, burn → closest swap after) and flagged the 4 outlier transactions caused by block-index differences.

Week of October 8th

Mid-month was about turning pricing into testing. Aaron added swap-fee and hedge-cost modeling to backtesting, while Artem and Yuriy refined APR accuracy with Aerodrome data. Rika standardized true HODL XIRR methods, and Theo confirmed positive USD XIRR remains possible even with impermanent loss when timing is right.

On the community side, Crypto_Land_DAO ran weekly FlappyH1 airdrops and NFT rewards, EasyNodePro refreshed validator dashboards with live $ENP stats, AthleteFi shared its #Web3Sports recap, and Kratos highlighted Harmony’s Q4 focus on mainnet stability.

Top 3 Team Progress:

Aaron: Computed swap-fee earnings inside backtesting and improved hedge-fee accounting so BTC LP-hedger sims reflect real CEX costs.

Theo: Documented comprehensive LP HODL and updated TRUE HODL XIRR to ~7.5%, proving the method as the baseline for LP vs. hold comparisons.

Yuriy: Updated the analytics service to search BTC prices by swap history (with tx-index ordering) so positions that open/close in the same block stay price-correct.

Week of October 15th

This was the reliability week. Aaron focused on unit and end-to-end tests for the backtesting server, strengthening state handling for balances, positions, and PnL. Artem published the first wallet lists with income and time-in-position, which Theo used to identify top-performing strategies. Rika continued timeline analysis for high-volume wallets, while Gheis refined stream sync for mainnet and Konstantin advanced the Duktape-to-Goja migration for future-proof tracing.

On the community side, Kilopi’s on-chain Web3 strategy game crossed 15,000 transactions and 1.4M $LOP rewards, Crypto_Land_DAO spotlighted Harmony’s EIP-2935 upgrade, and Kratos celebrated 1-second finality successfully deployed in devnet.

Top 3 Team Progress:

Aaron: Built out backtesting unit tests + E2E with refined APIs, so LP-hedger can be replayed deterministically on production data.

Artem: Published the second version of the September wallets list, now with income, time-in-position, and range-limited data (Sep 4–30) to match our bot stats.

Gheis: Continued mainnet-prep work for Stream Sync — cleaning legacy logic, validating staged sync, and watching for rare partial-block edge cases on testnet.

Ever wondered how protocols keep BTC yield without impermanent loss?

YieldBasis is one example it uses a 2x leveraged design on Curve that auto-rebalances debt and collateral to track BTC’s price precisely. Here’s how it works 🧵

Week of October 22nd

This week shifted from analyzing wallets to copying them. Artem, Yuriy, and Aaron aligned on building a real-time mirror system: exporting six months of swap data, modeling hedge positions, and teaching the copy-trading bot to open and close positions at the same pace as target wallets. Aaron added sanity checks to backtesting APIs, Yuriy tested live and historical modes with proportional deposits, and Artem reduced latency by moving approvals to bootstrap. Rikako reran timelines after these fixes, syncing analytics with raw wallet data.

On the community side, Crypto_Land_DAO shared the Stream Sync update from Harmony’s Youtube and weekly FlappyH1 winner posts, while Kratos highlighted Harmony’s 5.country AI robotics research.

Top 3 Team Progress:

Artem: Reduced copy-trading bot latency (token approvals at bootstrap, optimized network calls) and exported 3M+ swaps for long-period hedge estimations.

Yuriy: Deployed the MVP copy-trading bot to Fly.io with logging and action-comparison tables, plus historical-replay mode for tracked wallets.

Aaron: Added sanity-check stats and swap counts to the backtesting API so strategy runs can be audited and compared across platforms.

Week of October 29th

To close October, Aaron refined and deployed the BTC LP-hedger on the matured backtesting stack and separated database connections so backtests run independently from analytics. Artem launched the LP-backtest server locally and built a dedicated script to replay wallet strategies. Gheis shipped two major PRs introducing role-based sync and early-exit logic, bringing Stream Sync to mainnet readiness. Ulad strengthened ops with full Loki crash collection and Base Reth upgrades.

On the community side, Crypto_Land_DAO celebrated Harmony’s EIP-2537 cryptography upgrade and network improvements for faster sync and Ethereum compatibility. Kratos shared Harmony’s Q4 plan for 1-second finality and transient storage, while Tenacious DeFi burned nearly 36M $WAGE in ongoing DeFi campaigns. Fortune.ONE shared validator guides to simplify staking and onboarding, keeping Harmony’s ecosystem active as the network advanced into Q4.

Top 3 Team Progress:

Aaron: Refined backtesting and deployed the BTC LP-hedger, swapping out older SugarPosition queries for more reliable contract read methods and isolating DB connections.

Gheis: Shipped PRs 4959 and 4961 — role-based sync strategies + making Stream Sync the default on devnet/testnet — essentially the final step before mainnet rollout.

Artem: Brought up Aaron’s backtest server locally and added wallet-level backtesting methods (mint/burn/observe) so we can replay real September strategies.

Harmony’s network is leveling up. New upgrades make the network faster to sync, more Ethereum-compatible, and stronger at cryptography and data access. Here’s what’s new 🧵

Conclusion

October marked a turning point where Harmony’s infrastructure and strategies became production-ready. Backtesting graduated from spreadsheet experiments to strategy-grade simulations—modeling swap fees, impermanent loss, tick widths, and real CEX hedge costs on live data.

Stream Sync reached mainnet stability with leader-based strategies and early-exit logic, sustaining 1-second finality without compromising integrity. Meanwhile, the copy-trading system proved that wallet mirroring is not just theoretical. By bundling open, stake, and rebalance actions into single transactions, the team laid the groundwork for automated, on-chain strategy replication. Together, these advancements position Harmony for the next phase: self-sustaining yield, faster consensus, and data-driven DeFi automation. 💙