July 2025: LP Bots Go Live 🤖 Validator Voting via SnapshotX 🗳️ BTC/USDC Yield Strategies 📈

July marked a new phase of progress for Harmony. Onchain strategies matured, LP bots went live, and governance tooling advanced. Building on Q2’s momentum, the team focused on improving real-world performance of BTC yield vaults—refining LP strategies, improving APR tracking, and syncing trade data across Aerodrome, Uniswap, and Hyperliquid.

Monitoring systems were expanded for better visibility, database syncing became more stable and insightful, and validator voting advanced through SnapshotX. Meanwhile, the community rallied around the return of voting infrastructure, recovery efforts, and a renewed focus on long-term coordination. From protocol-level fixes to portfolio tracking, July brought Harmony closer to its mission: trustless yield, transparent systems, and decentralized decision-making at every layer.

Week of July 1st

Kicking off Q3, the team focused on refining LP hedging infrastructure and debugging advanced rebalancing logic for BTC strategies. LP bots were deployed in replicable environments, with edge cases handled for concentrated positions. Core vault analytics saw precision upgrades across Aerodrome and Uniswap V3, while our protocol layer stabilized with better sync handling and validator tooling. Strategy reviews continued, drawing insights from on-chain performance and academic sources to guide minimal-rebalance designs.

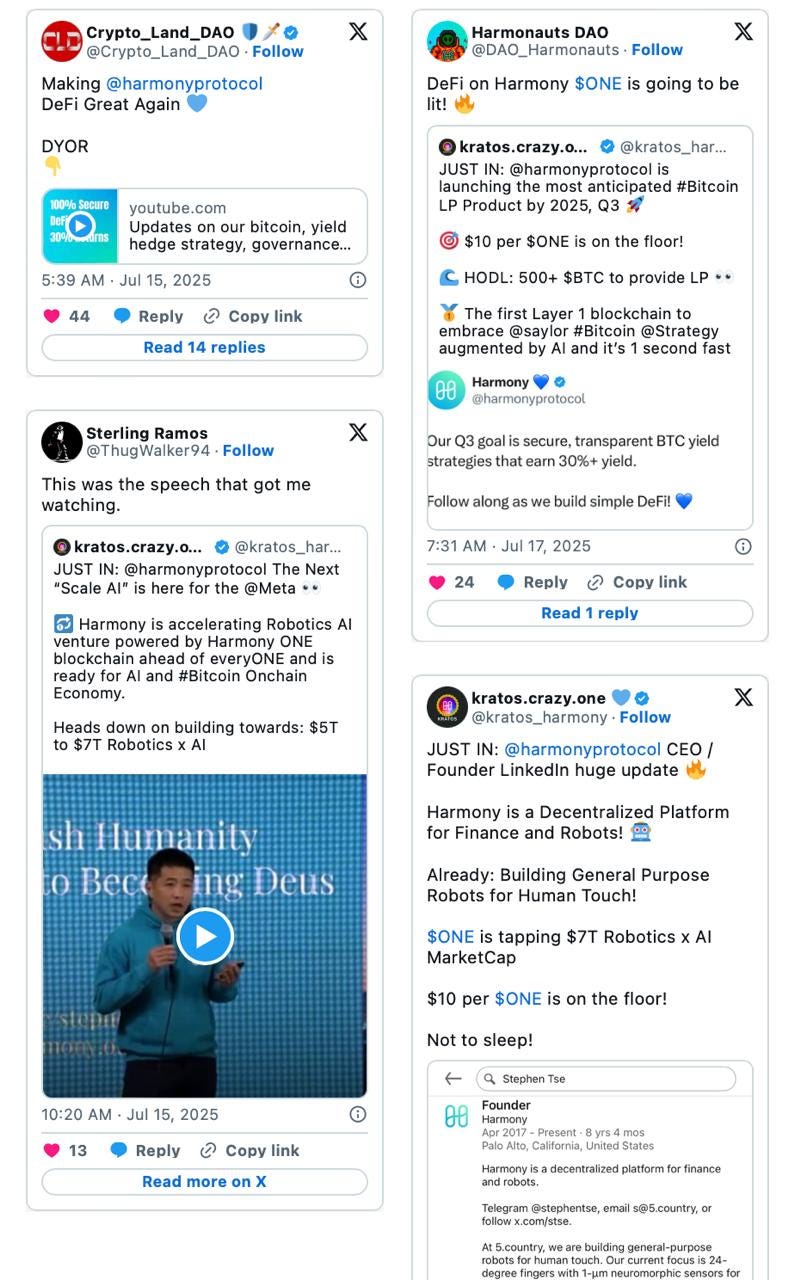

On X, community updates included a bullish outlook on video NFTs, Harmony’s Q2 achievements, and a closer look at our multi-billion dollar vision for robotics. Crypto_Land_DAO kept spirits high with continued FlappyH1 rewards, and the Harmony ecosystem rallied behind BTC hedging, validator upgrades, and robotics momentum.

Top 3 Team Progress

Artem completed LP swap logic and rebalancing tools for BTC strategies, supporting out-of-range LP positions using Uniswap V3 and Aerodrome.

Frank fixed core APR, liquidity, and tick calculation bugs in Aerodrome backtesting, achieving realistic concentrated liquidity models without relying on multipliers.

Gheis improved epoch sync logic by eliminating unnecessary retries, reducing log overload, and began exploring BLS cryptographic primitives (EIP-2537) for validator performance.

Week of July 8th

Week two brought major refinements across our LP rebalancing infrastructure, from new backtesting tools and unified TSV exports to the launch of persistent analytics services. The BTC LP strategy evolved with asymmetric range modeling, automated APR calculations, and enriched simulation data. On the protocol side, research and implementation of BLS precompiles began to improve validator efficiency, while SnapshotX, governance tools, and database infrastructure made strides in modularity and speed.

Ulad made key infrastructure optimizations, reducing the SnapDB size by over 70% and upgrading bootnodes to improve network stability. He also began visualizing stream sync metrics across devnet using Prometheus and Grafana—an important step toward full-scale observability of Harmony’s peer-to-peer system.

Across the community, UtilityDAO proposed to become a recovery partner and RecoveryOne celebrated the development of voting infrastructure on Harmony. @FlappyH1 announced the winner of their weekly airdrop and @HOGtokenONE promoted governance discussions.

Top 3 Team Progress

Frank launched a unified backtesting output format across Aerodrome and Uniswap, improving APR tracking, PnL insights, and fee distribution modeling with hourly and daily precision.

Yuriy split the analytics system into modular services with tick-level stats and PostgreSQL integration, improving data fidelity and analysis speed for LP strategies.

Ulad reduced SnapDB size from 420GB to 120GB, stabilized bootnodes with hardware upgrades, and began Grafana-based visualization of stream sync metrics for devnet.

Harmony BTC/USDC Vaults: How Will They Actually Earn 30%+? Let’s Break It Down 🧵

We're rolling out a BTC/USDC vault, built to help users earn yield while holding BTC exposure. But how does it really work? And how do we manage risk?

How the Vault Generates Returns:

1) Funding Rate Arbitrage: When funding rates are high on perp exchanges, LPs earn by passively taking the opposite side.

2) Range-Bound Liquidity Provision: We concentrate liquidity in high-volume price ranges to capture trading fees efficiently.

3) Hedged Positions: The vault uses hedging to stay close to delta-neutral. This helps reduce risk while compounding fees.

Week of July 15th

In Week 3, Harmony’s BTC yield efforts matured with new asymmetric LP rebalancing models, improved tracking of fee performance, and continued refinements to backtesting frameworks. Aerodrome and Uniswap backtesting logic became protocol-agnostic, enabling seamless fee modeling across AMMs. Monitoring dashboards were upgraded to visualize 1-second finality and sync issues in real time, while database syncing for trades, positions, and APR metrics saw a round of fixes and optimizations.

Top 3 Team Progress

Aaron implemented daily and cumulative LP fee tracking across Aerodrome and Hyperliquid, improving trade sync logic and internal performance reporting for the BTC/USDC strategy.

Frank completed token-agnostic rebalancing logic and added impermanent loss modeling, volatility-adjusted ranges, and fee forecasting across Aerodrome and Uniswap.

Gheis submitted the first PR for BLS12-381 precompiles, enabling efficient on-chain BLS signature verification and improving consensus mode handling during epoch syncs.

Most DeFi strategies hedge in both directions — neutralizing market risk but capping upside. But what if you're already long on BTC for the next decade? 🧵

A one-sided BTC hedge lets you stay exposed to upside, while farming yield with minimized downside management.

The approach: LP your BTC, hedge selectively with perps, reinvest fees and incentives, and optimize rebalancing. No need to constantly react to the market — you’re playing the long game, not timing tops and bottoms.

Week of July 22nd

We closed July with deep protocol upgrades, yield strategy execution, and governance tooling advancements. Across LP rebalancing bots, Docker deployments, and backtesting enhancements, the team improved APR modeling, PnL tracking, and hedging simulations. Artem and Frank aligned on a complete LP strategy engine with real-market performance, while Aaron reinforced trade-sync systems and APR calculations. On the protocol side, Gheis advanced BLS precompile support with benchmark updates, and Ulad assisted Pocket Network with archival sync solutions.

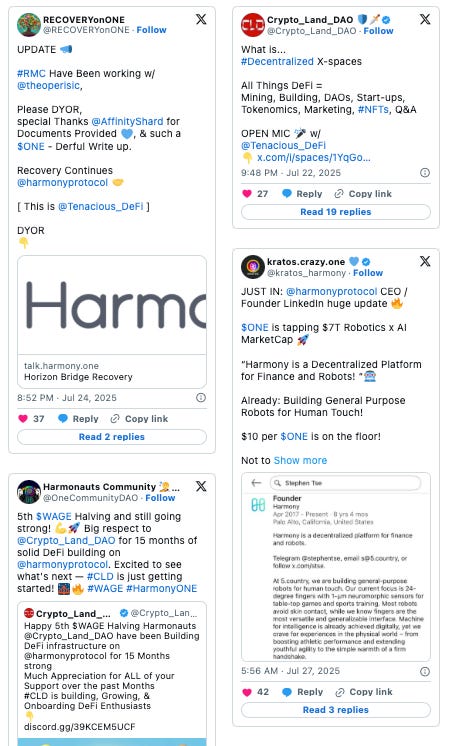

Community-wise, discussion about recovery continued and @CryptoLand_DAO celebrated 15 months of DeFi building on Harmony and hosted a space discussing all things DeFi.

Top 3 Team Progress

Artem deployed and tested the new LP strategy bot in Docker, supporting position-specific configuration and rebalancing logic tied to live market conditions.

Frank refined Aerodrome analytics by reconstructing AERO reward tracking and improving LP strategy logic to dynamically adjust ranges and track impermanent loss with near-perfect efficiency.

Yuriy finalized validator-weighted SnapshotX voting with a new relayer, validator snapshot logic, and restrictions on governance space creation.

AI just won gold at the International Math Olympiad

OpenAI and Google’s models solved 5/6 problems using general-purpose LLMs under real exam rules. The age of AGI for formal math has begun

Conclusion

As July wraps, Harmony continues refining DeFi yield strategies, governance, and protocol performance into one unified vision. With real-market LP strategies deployed, trade and fee syncing live, and validator-weighted voting in place, the foundation is taking shape. Steady engineering progress and community coordination are driving the development of the next vault—and the next chapter. 💙