April 2025: Stablecoins Yield Strategies 🌱, Onchain Profits with Subgraph ✅, Typed Protocol Transactions 📜

April opened with strong momentum across yield strategy research, protocol upgrades, and infrastructure improvements—laying groundwork for future DeFi and wealth-building products.

On the community side, projects like Jeet Bets, AthleteFi, FlappyH1, and Crypto_Land_DAO continued development through weekly airdrops, the launch of GameFi products, and membership growth.

Week of April 1st

The first week of April at Harmony focused on yield strategies, protocol improvements, and new tooling. Aaron, Artem, and Yuriy dove deep into VFAT vaults, stablecoin pairs, and impermanent loss modeling. Frank resolved key issues in the Pendle/Sonic subgraph and deployed new event tracking. Gheis refactored sync logic for better reliability, while Konstantin pushed Ethereum 1.10 upgrades to devnet. Sun and Ulad handled server updates and Continuous Integration fixes, and Rikako advanced strategy research on Euler and Rings.

On the community front, Alaina shared Q1 progress, shared JEET Bets marketing, and posted threads on DeFi cycles and BTCFi. Theo prepped Q2 yield tools, including real-time volatility tracking. Top tweets included the JEET Bets launch, BTC’s untapped yield potential, a farewell to Soph, and insights on Rho's hedging power.

Top 3 Team Progress

Frank resolved critical indexing issues, redesigned entity schemas, and successfully deployed the Pendle rewards subgraph. This enabled accurate tracking of rewards and improved infrastructure for DeFi users, unlocking better analytics and yield visibility.

Gheis refactored the block body download loop to a pull-based worker model, eliminating deadlocks and improving sync reliability. This foundational improvement enhances protocol stability and maintainability across all nodes.

Aaron conducted a week-long deep analysis on stablecoin DEX yields, Penpie security post-exploit, BTC yield integrations, and funding rate-based strategies. His research directly informs vault design, user safety, and future yield product development.

“After 6 years, we’re saying goodbye to @sophoah— Harmony’s Lead DevOps Engineer and a pillar of our protocol team. Your work helped build the foundation we stand on today. Thank you for growing with us. Wishing you all the best”

Week of April 8th

This week, Frank expanded the Pendle subgraph with detailed yield tracking, while Theo and Yuriy optimized VFAT analytics and impermanent loss modeling. Aaron tested advanced hedged stablecoin strategies, and Artem, Rikako, and Frank refined APR accuracy across Pendle, Euler, and Spectra. Ulad improved validator diagnostics; Gheis pushed sync upgrades.

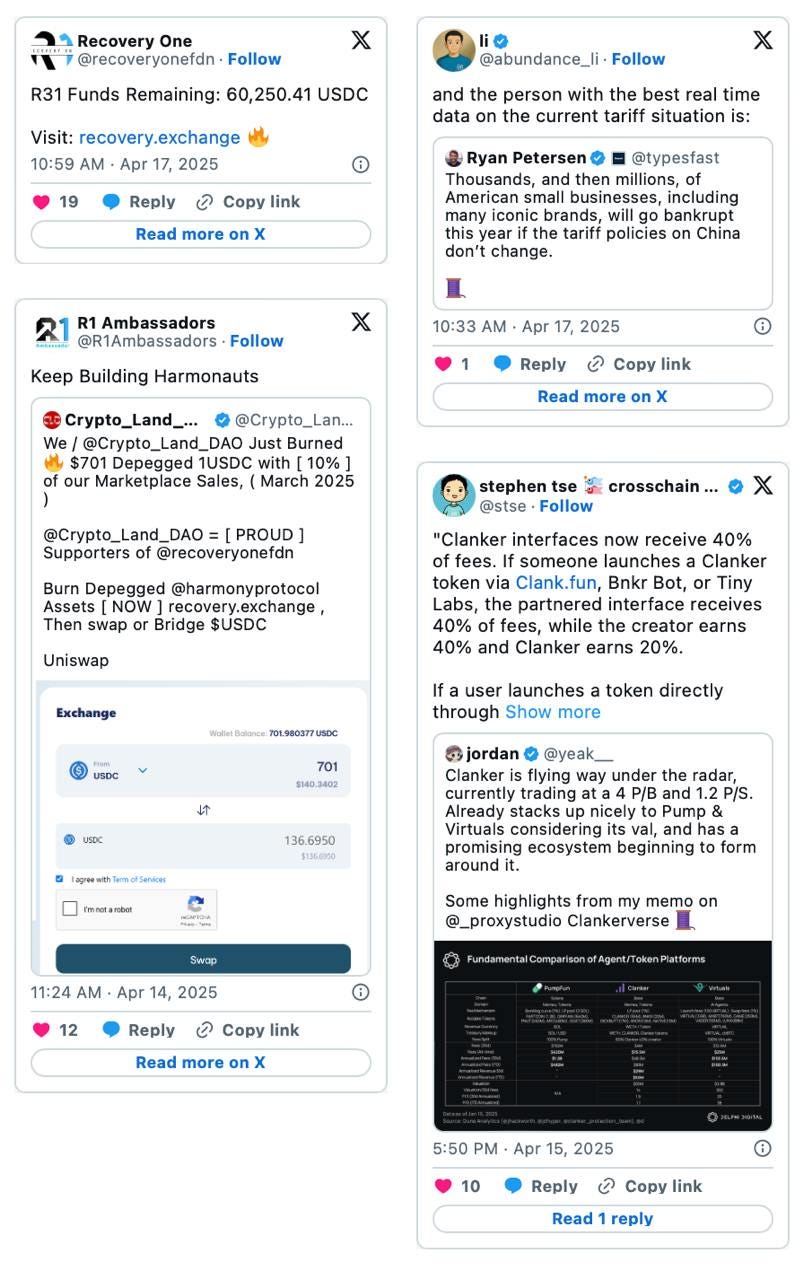

Recovery Round 31 went live, letting users swap and burn depegged assets via OpenOcean. Alaina began Colossus marketing content and threads on restaking and Berachain. Top tweets covered Recovery One, restaking, Swap.Country UX, and macro reflections on trade.

Top 3 Team Progress

Frank implemented detailed tracking of Pendle yield components (PT, LP, underlying), added boost factor analytics, and expanded the subgraph with multiple event handlers—laying the groundwork for a full-featured yield dashboard.

Theo built tools for backtesting rebalancing strategies using real-time volatility, while Yuriy extended shadow pool analytics and linked strategy parameters to performance—crucial for optimizing LP positions.

Aaron tested hedged stablecoin strategies using lending, funding rates, and derivatives across platforms like Deribit and Panoptic, providing actionable insights for future yield product design.

“Anyone can launch a token on pump.one! Launch, mint, burn, or compete for the highest liquidity”

Week of April 15th

Aaron, Artem, Rikako, and Theo advanced stablecoin yield strategies and APR tracking across Pendle, Spectra, and Euler. Konstantin resolved a key consensus bug and streamlined syncing, while Gheis deployed devnet-wide stream sync upgrades. Yuriy expanded VFAT strategy analysis, Frank refined Pendle/Aave reward tracking, and Sun progressed typed transaction persistence. Ulad fixed testnet networking issues and added Ledger support, while Philipp explored option-based yield products and volatility signals.

Ecosystem updates included Recovery Round 31’s remaining funds, a USDC burn by Crypto_Land_DAO, and Clanker’s new 40/40/20 fee model gaining traction.

Top 3 Team Progress

Gheis successfully deployed stream sync across all devnet nodes, a major stability improvement that strengthens network reliability and readiness for future mainnet updates.

Konstantin fixed a critical consensus bug during view changes and streamlined block syncing logic, reducing risk of leader disruptions and making consensus more efficient.

Artem integrated APR tracking across Spectra, Pendle, and Euler into a single portfolio script, strengthening yield analysis and strategy tools.

“Charlie Munger warns: misjudgment is human — incentives twist, ego blinds, certainty deceives. Be the ONE to disconfirm your beliefs. Be the ONE to dare, to listen, to rethink. That’s how lasting systems — and people — grow.”

Week of April 22nd

During the final week, Aaron and Artem explored new stablecoins and hedging strategies, diving into reUSD, synthetic puts, and LP risk across Beefy and Euler. Frank and Rikako analyzed SY reward mechanics on Pendle and Equilibria, uncovering key differences in streaming distributions and actual yields. Frank also updated Harmony1Bot’s AI tools with new OpenAI models, while Alaina pushed new visuals and promoted FlappyH1.

Top tweets featured the upcoming Harmony Yield Enhancer, Pendle’s Boros launch, and FlappyH1 weekly airdrop.

Top 3 Team Progress

Frank dissected Equilibria’s SY reward structure, clarified APR gaps from streaming mechanisms, and updated Harmony1Bot’s AI stack with new OpenAI models for future deploys.

Artem researched delta-neutral strategies on Euler, tracked impermanent loss across pools, and began building a wallet performance tracker.

Aaron explored a wave of new stablecoins (like reUSD, f(x), alUSD) and researched synthetic puts and rate-based hedging tools to support next-gen stable yield strategies.

Conclusion

April closed with deeper infrastructure upgrades, refined stablecoin strategies, and expanded portfolio tracking tools. From protocol improvements to yield analytics, each step advanced Harmony’s mission of building cross-chain infrastructure and simple DeFi.

Heading into May, the focus turns to researching new yield products and expanding the foundation for an onchain wealth network.

Hiring: (DeFi) Engineers

To build a cross-chain portfolio agent: rebalance asset allocations, optimize pool yields, hedge market risks, analyze research reports, and recommend daily actions. You must:

Work 60+ hours per week.

Have a degree in computer science.

Message me at t.me/stephentse.